Does the stock market overreact?

Some companies fall off the radar of mainstream investors. After all, investment managers don’t typically generate fees by simply buying and holding long-term positions. When a company loses its momentum or hype, buyer interest often fades—while selling pressure persists. At times like these, valuations can become dislocated. That’s often when the so-called "smart money" starts to take notice, identifying potential bottoms. What remains is a business poised for a potential turnaround.

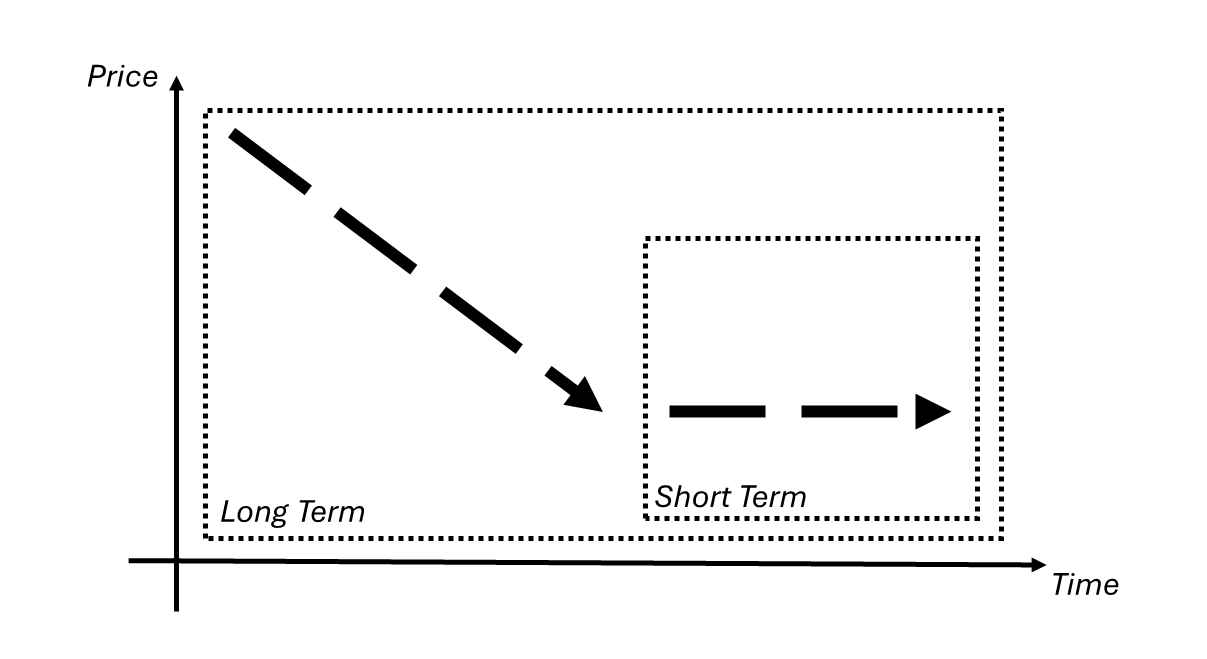

Setting:

- Market Cap: >$100mio

- Dividend Yield: <2%

- Short Term: -3%-3%; Duration: 20d

- Long Term: <-15%; Duration: 20w

- Beta: 1 - 0