Preset Strategies

Pre-configured screens based on proven market patterns. Select a preset, set your delivery preferences, and start receiving stock ideas that match your strategy.

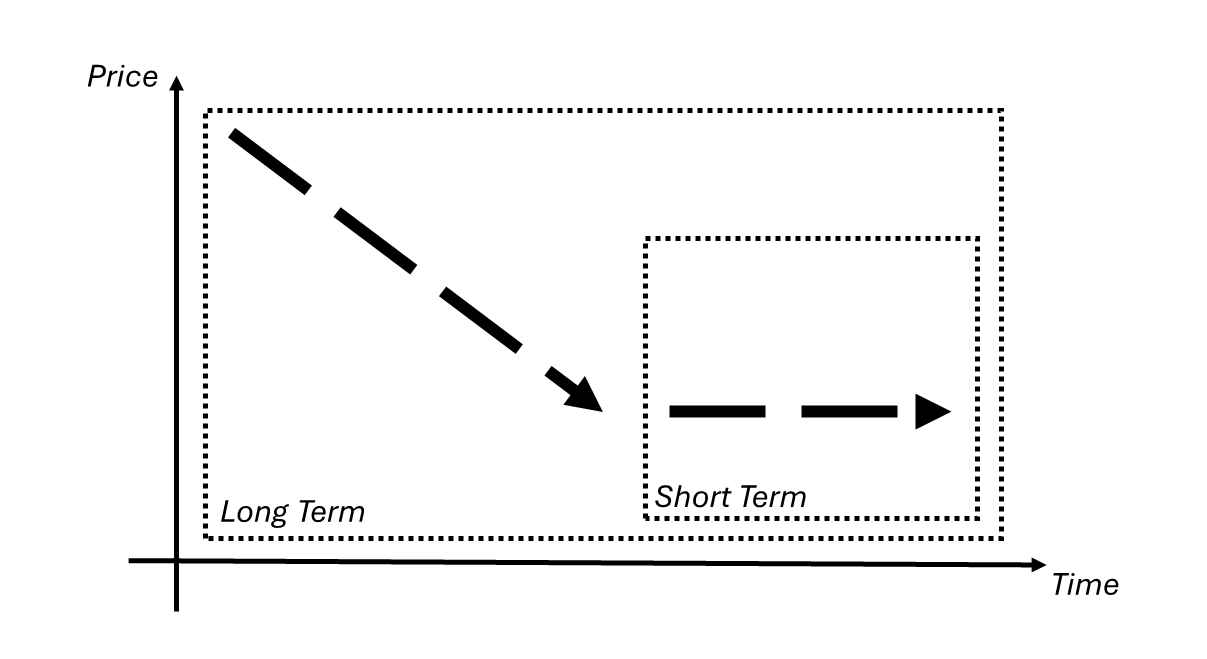

Turnaround Trophy

Catching the recovery after the fall

Identifies companies that have experienced significant drawdowns but show signs of stabilization. Focuses on stocks with moderate volatility and dividend yields, suggesting potential for recovery.

Key Filters

- Market Cap: > $100M

- Dividend Yield: > 2%

- Short-term: -3% to 3% (20 days) – stabilization

- Long-term: < -15% (20 weeks) – significant drawdown

- Beta: 0 to 1 – lower volatility

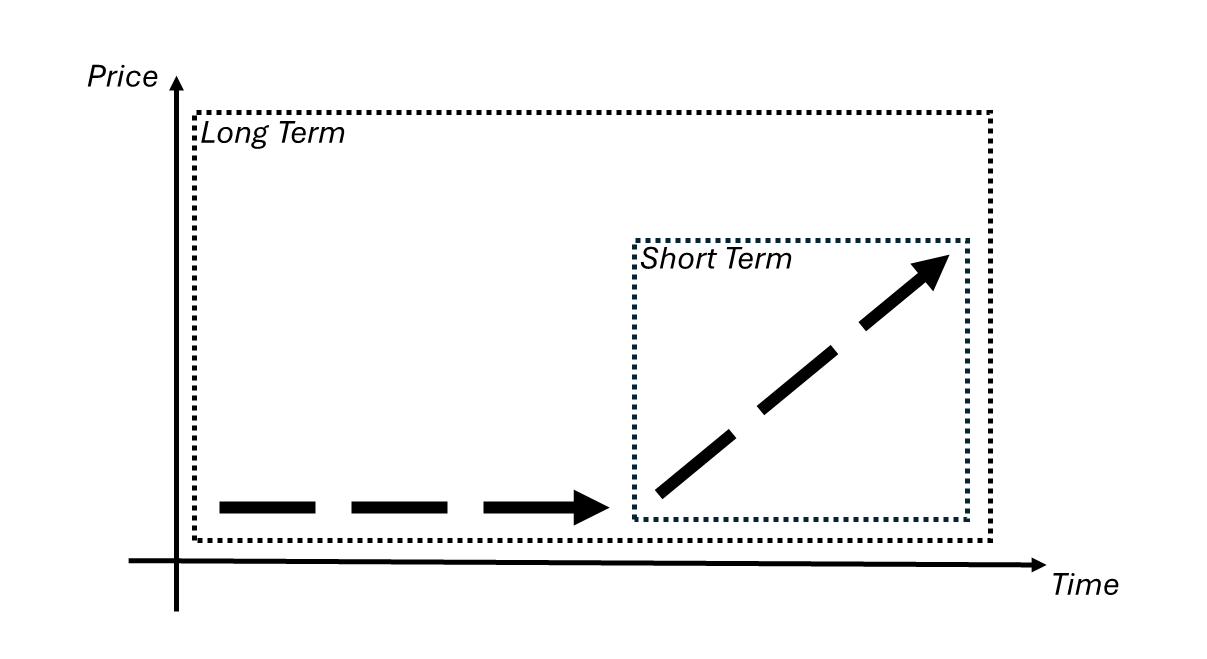

Bottom Dynamics

Momentum building from the bottom

Captures stocks showing early signs of momentum after a period of underperformance. Targets companies with recent short-term gains while maintaining long-term value potential.

Key Filters

- Short-term: 20% to 30% (20 days) – building momentum

- Long-term: < 30% (20 weeks) – recent recovery phase

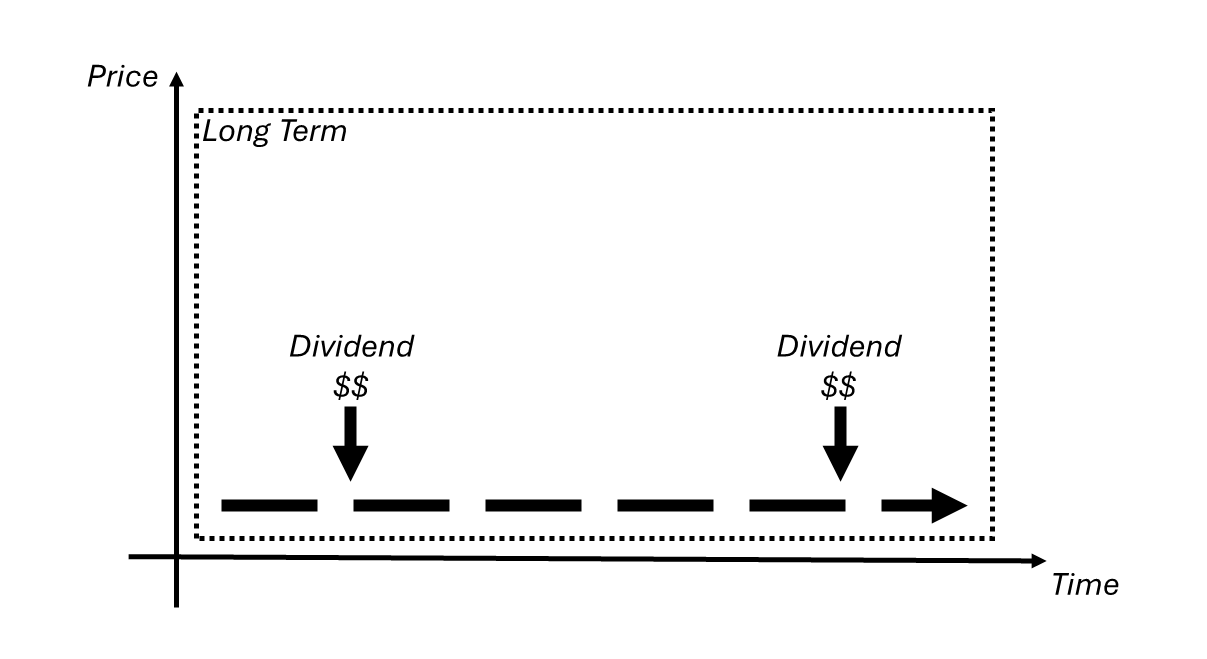

Cash Machines

Established companies returning capital

Focuses on mature, stable companies with strong dividend yields. These businesses prioritize shareholder returns over aggressive growth, offering steady income potential.

Key Filters

- Market Cap: > $500M

- Dividend Yield: > 4%

- Short-term: -10% to 10% (30 days) – stable pricing

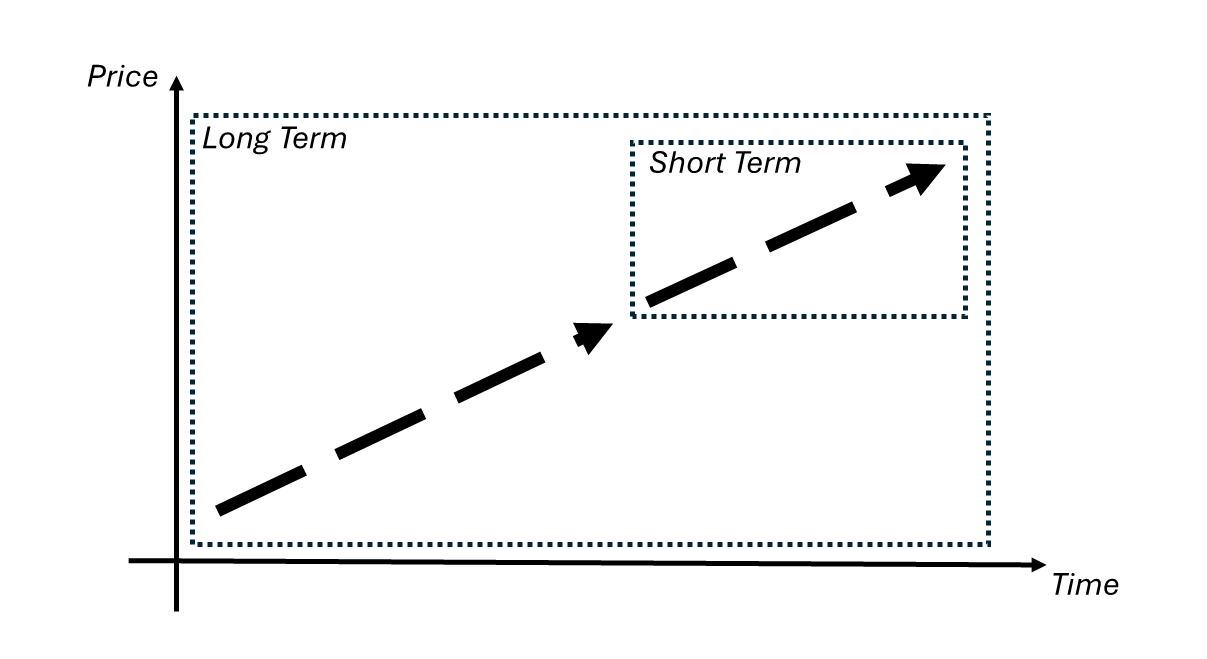

Momentum Markets

Riding the acceleration wave

Targets stocks with strong momentum in both short and long-term timeframes. Identifies companies experiencing sustained upward price movement and market interest.

Key Filters

- Short-term: 10% to 75% (20 days) – rapid acceleration

- Long-term: > 50% (20 weeks) – sustained momentum

Configure Your Delivery

Select a preset above, then customize your delivery preferences and expertise level below.